As the nation is fighting the menace of COVID-19 relief measures are coming in from the government. Yesterday Finance Minister Nirmala Sitharaman unrolled the ‘1.7 lakh’ relief package amidst 21 days lockdown.

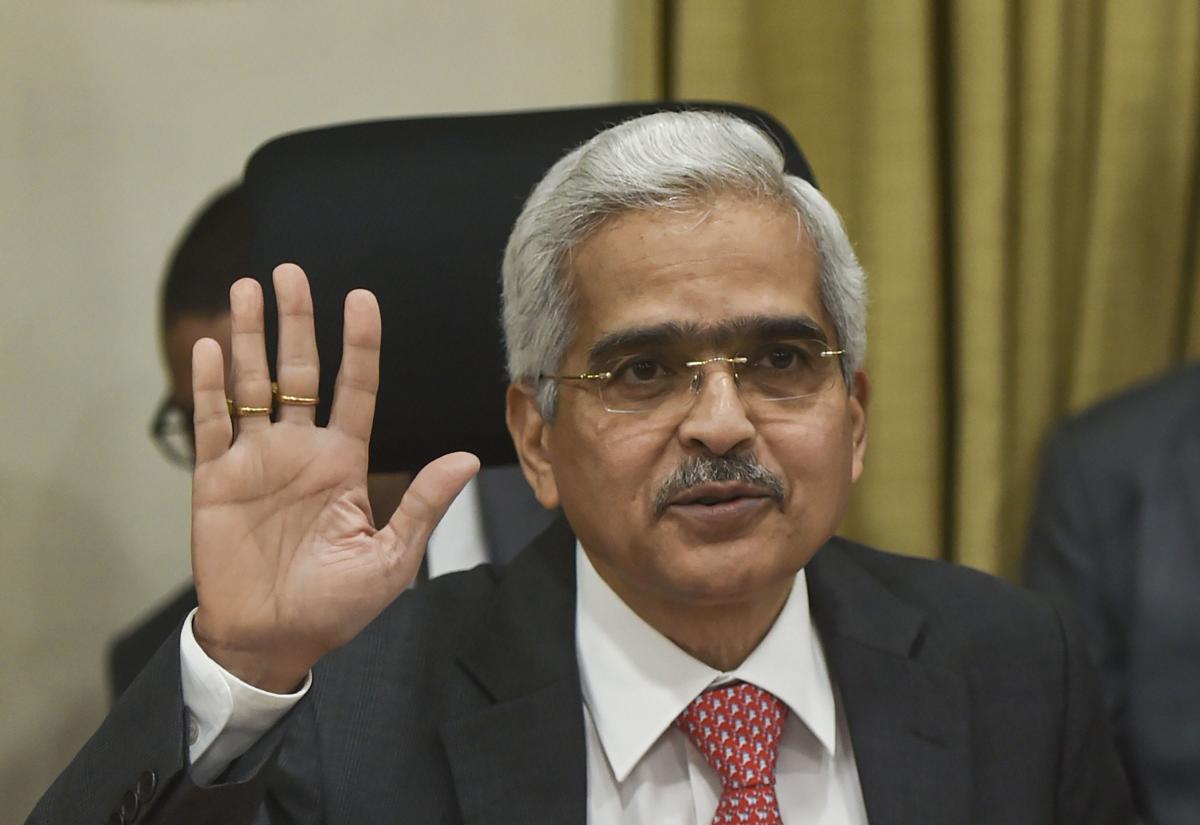

On Friday it was Reserve Bank of India’s (RBI) governor who came in with some measures. RBI Governor Shaktikanta Das announced the reduction of 75 basis points in the repo rate to 4.4%. On the other hand, reverse repo-rate has been reduced by 90 basis points to 4%. This means taking loans would be cheaper from the banks. The reduction in repo rate was a historic as it was the biggest cut by RBI so far. The announcements were part of RBI’s bi-monthly policy.

The big relief was there for EMI payers. Governor Das also permitted banks to have a 3-month moratorium on the repayment of installments for term loans outstanding as on March 1, 2020. Further deferment of 3 months on interest payment on working capital facilities is also allowed. PM Narendra Modi termed the announcement as a ‘giant step‘.

Also Read: ‘Ramayan’ Is Back On ‘DD Network’, To Give Your Nostalgia A Break During Lockdown

However, only the banks will decide which loan they want to give EMI exemption. This means that there is still a kind of confusion for people taking retail, commercial or other types of loans. The cash reserve ratio (CRR) has also been reduced by 100 basis points to 3 percent. This has been done for a period of up to one year.