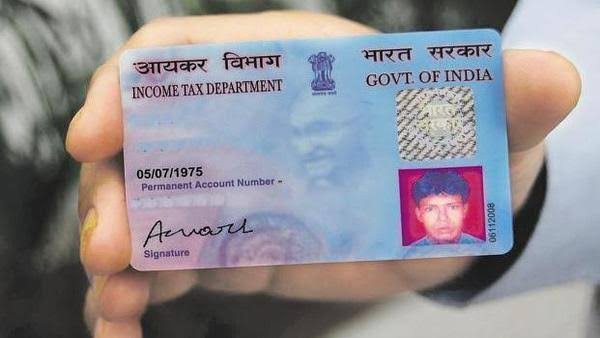

Are you someone who is sharing his/her Permanent Account Number (PAN) related details on social media? If yes, then firstly it’s a bad habit and second, it makes your personal information prone to getting exposed and misused.

The Income Tax (IT) department has issued warnings to all the PAN holders to not share there ten-digit alphanumeric PAN openly on social media in order to prevent misuse of there information by anti-social elements.

Also Read: Top 14 Highest Grossing Bollywood Movies Of 2019

A number of taxpayers ask queries related to the processing of income tax returns, ITR refunds, etc on Twitter. And people in a hut to get the information often mention their PAN details along with other particulars online.

The social media team of the IT department keeps on tracking people who mention there PAN details on tweets and comments and warns them to avoid doing this in order to prevent potential misuse.

“May we also request you not to share personal details like PAN on social media to avoid it being misused” is a standard response that the IT department’s social media sends to the taxpayers who reveal there PAN details in tweets.

Also Read: We Applied Prakash Javadekar’s Pollution Logic To Multiple Indian Facts And Here Are The Results

Sharing of such crucial financial and personal details leads to thefts and frauds wherein anti-social elements can make transactions from your bank accounts without your knowledge.

Linked Danger

In a similar kind of warning, the Unique Identification Authority of India (UIDAI) urges all the Aadhar cardholders to not share their 12-digit Aadhar number anywhere on the public platforms. Since the Aadhar is linked with PAN, both Aadhar and PAN are prone to getting easily accessible to hackers. This can lead to extraction of money and even sensitive information.

Also Read: People Say Only Women Can Do This ‘Chair Challenge,’ Can you Do It?

To simplify and streamline the process of asking queries and raising concerns for taxpayers the IT department has come with an online platform and app namely Aaykar Setu. Taxpayers would be able to get answers directly from the IT officials for there queries and concerns on the same.

Users would have to fill a form keying in certain details like name, PAN, assessment year for which the issue is reported, mobile number, email id, detailed query, and social media user-id to get there issue/concern registered and to get an answer.

Also Read: 10 Lamps Under Rs. 1,500 That Will Brighten Your Room This Winter

The form is basically meant for answering queries related to e-filing of ITR, processing and claiming tax refunds. Post filling of the form taxpayer can expect a quick response from the side of the IT department.