Banks and the whole financial system function on a set of criteria that are defined from time to time and determined by competent authorities. Banking is a service-driven industry with regular public dealings, hence various phrases are employed inside the system.

These are services or definitions of a certain procedure. When common people are unfamiliar with these concepts, they might become confused or waste time trying to clear their doubts.

Must-Know Finance Terms For Strong Banking Knowledge

Mobile Banking

Most banks now provide digital services that can be accessed via a variety of channels. Mobile banking is one such technique, in which a consumer gets banking services via their mobile phone by following the processes outlined by the different institutions.

Repo Rate

The annualized interest rate on funds transferred by the lender to the borrower is known as the repo rate. This is the interest rate at which the RBI loans to commercial banks.

KYC

KYC stands for “Know Your Customer”, and is a mandated method that all banks/NBFCs and other RBI-regulated organizations must employ in order to verify a customer’s identification. It entails providing a set of papers, such as an Aadhaar card or a PAN card.

Credit History

Credit history is a record of a customer’s credit behavior in the past with reference to loans. A credit bureau, such as CIBIL, collects a customer’s information. Lenders will look at this before issuing you a loan to assess your credit discipline or your credit score.

Also Read: Major FAQs Related CIBIL or Credit Score to Clear All Your Doubts

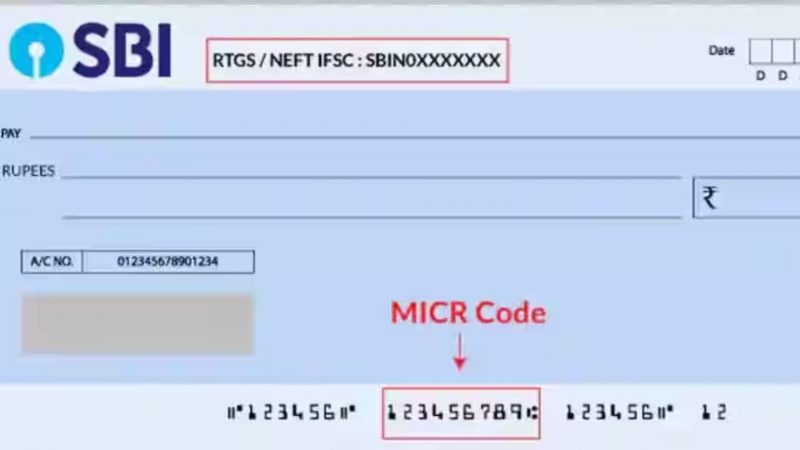

MICR

MICR stands for Magnetic Ink Character Recognition. It is a nine-digit code found in the bottom right-hand corner of the bank cheques. This helps in simplifying the clearance of your cheque.

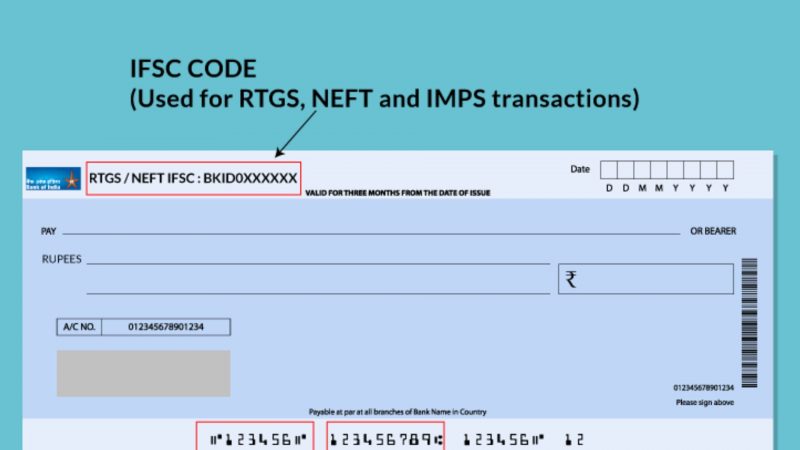

IFSC

The Indian Financial System Code (IFSC) is an 11-digit alpha-numeric code. IFSC is required to transfer money across bank accounts. It enables the electronic transfer of funds from one bank account to another.

Plastic Money

This word refers to a currency other than physical cash that is utilized by humans. It is commonly used to refer to debit and credit cards.

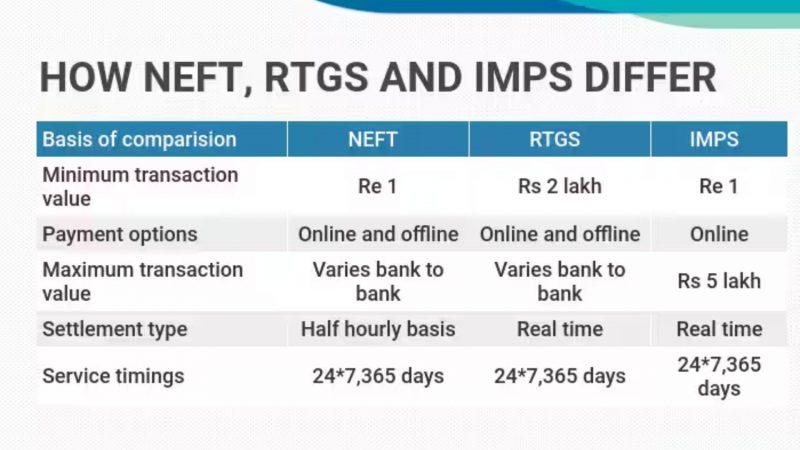

RTGS

RTGS stands for Real Time Gross Settlement, is another cash transfer technology that banks may use to move payments. It is typically used for larger quantities. For example, the minimum RTGS transfer value at the State Bank of India is Rs 2 lakh, but the minimum NEFT transfer amount is Rs 1.

NEFT

NEFT is an acronym that stands for National Electronic Funds Transfer. It is, as the name implies, a procedure for transferring money from your bank account. It is an electronic method of transferring funds from one account to another, regardless of branch or bank. However, depending on the bank and the amount, NEFT fees vary.

IMPS

Immediate Mobile Payment Services (IMPS) is another inter-bank funds transfer method in which money is transmitted in real-time. It indicates that the transaction is instant and the balance is immediately reflected.