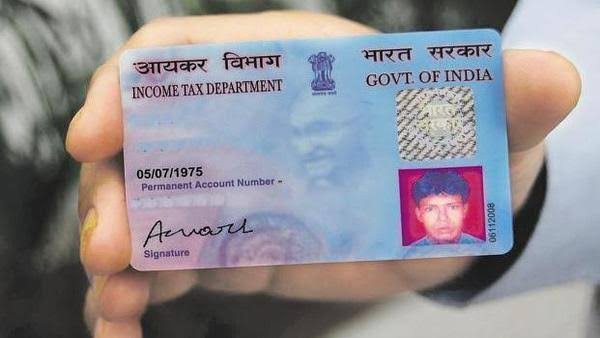

Well, while the government has pushed the limits for most of the things this is only till 30th June as of now. And if you are a PAN (Permanent Account Number) holder then you must act quickly to save the penalty of Rs 10,000. The deadline to link PAN card with Aadhaar card is just around the corner after an extension of 3 months from March 31st.

If after June 30th you have not linked your PAN with Aadhaar then as per Section 272B of the Income Tax Act you would have to pay a hefty fine. The fine is up to Rs 10,000 in this case. Further as per the act if the two cards are not linked then the PAN card will become ‘inoperative’.

If you have not yet filed your ITR, you will not be able to file it after the deadline is gone as PAN would become inoperative. Well, why to take such penalties and risk fora task that takes hardly 2-3 minutes and can be easily done online. Now, you might be wondering how.

Well, we have already covered in depth how the 2 cards can be linked and what are all the possible ways to do the same. Just Click Here and you can access the step by step guide for that. So, what are you waiting for? Go and click on the above link and complete the process.