A week after UPI transactions in India reached a record high of 10 billion in August, the NPCI now plans to increase UPI transactions from the current level of 10 billion per month to 100 billion per month.

The National Payments Corporation of India (NPCI), which manages the UPI network, has announced four new UPI products in this regard.

NCPI Announces New UPI Features

To increase UPI’s digital accessibility, new features released include a credit limit on UPI, UPI Lite X for offline payments and an NFC-enabled Tap & Pay feature, conversational payments via Hello! UPI and conversational bill payments via BillPay Connect.

The new offerings come only one day after NPCI CEO Dilip Asbe stated at the Global Fintech Festival 2023 that UPI has the ability to increase nearly tenfold and achieve a couple of billion transactions per day by 2030.

4 New UPI Features

1. Credit line on UPI

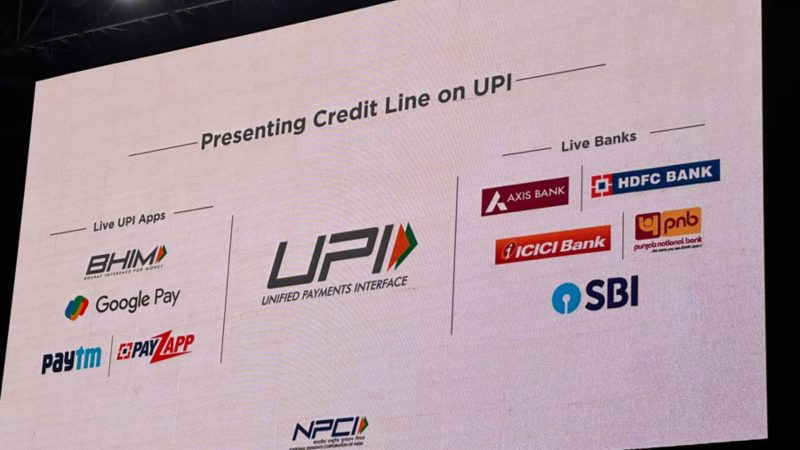

The credit line on UPI will enable consumers to pay for transactions using credit by linking pre-approved digital credit lines from banks. Furthermore, the payment flow for the new functionality will be the same as for existing UPI transactions. According to NPCI, ‘credit line on UPI’ will significantly speed up the process of obtaining, linking, and using credit lines.

This is also expected to provide banks and financial institutions an advantage in directly providing loans to a broader range of clients rather than relying on credit applications for distribution. Paytm, Google Pay, and HDFC PayZapp will be the first third-party payment providers to provide the ‘credit line on UPI’ service.

According to reports, NPCI chairman Asbe believes India’s credit market will be more than threefold by the end of this decade. He further stated that ‘sachetisation of credit’ is on the way, adding that the UPI operator is collaborating with HDFC Bank and ICICI Bank to achieve comprehensive digital onboarding. There is an opportunity to make credit available in real-time, and we are working on a service layer to empower customers to manage and use credit,” he explained.

2. UPI Lite X

UPI-operator NPCI unveiled UPI Lite X for offline payments, allowing users to send and receive money when entirely offline, expanding the use-case to include aeroplanes, tube stations and other retail locations. NPCI launched UPI Lite last year, allowing customers to perform small-ticket transactions without providing a PIN. This service is supplemented by UPI Lite X.

3. UPI Tap & Pay

Along with Lite X, NPCI also introduced UPI Tap & Pay, which allows users to make NFC-based payments. This comes on the heels of rivals Pine Labs and Paytm launching updated models of their point-of-sale (PoS) devices that allow merchants to accept NFC-based merchants, paving the way for the use-case’s adoption.

4. Conversational Payments – Hello! UPI and BillPay Integration

With the launch of Hello! UPI and BillPay Connect, NPCI has also ventured into conversational payments via its UPI service. It was revealed that NPCI was developing a speech bot interactive solution for Indian users to make UPI payments.

NPCI introduced Hello! UPI, allowing customers to conduct voice-enabled UPI payments in Hindi and English via UPI Apps, telecom calls, and IoT (Internet of Things) devices. It intends to launch the service in more regional languages.

Bharat BillPay introduces BillPay Connect, a nationalised number for bill payments across India. Customers may now retrieve and pay their invoices using the messaging app. Customers who do not have cell phones or quick mobile data access will be able to pay bills by placing a missed call.

Bharat BillPay Connect, a nationalised number for bill payments across India, is now available. Customers may now use the messaging app to retrieve and pay their bills. Customers without telephones or speedy mobile data connection can pay their bills by placing a missed call.