Before hopping on October 1, you might want to have a look at these five new rules being adopted by the Indian Government. These five rules will directly affect your day to day life from October 1, thus must concern you. Have a look:

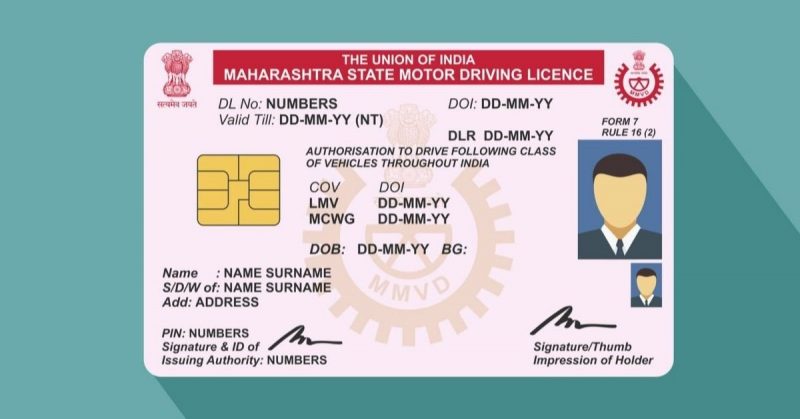

1. Easier driving license

The government has confirmed the maintenance of driving and e-challans documents on an online portal from October 1. Also, from Oct 1, no hard copy will be asked from customers for documents found valid electronically. In short, you will now be able to do most of your driving license work online as the licensing authority will record and update such details on the e-portal periodically.

2. More facilities in health insurance

According to the insurance regulator IRDA, three major health insurance changes will come into force from Oct 1. With first, the IRDA has asked all insurance companies to make their policies easier so that people can understand them. Second is to ensure insurance coverage for telemedicine. And third is that now insurance companies will need to provide claims easily.

Also Read: 33 Beautiful Pictures That Will Make You Wonder If This Is Really India?

3. Expiry date on unpacked sweets

The Food Safety and Standards Authority of India has ordered sweets shop owners to mention the expiry date on unpackaged sweets including the ones that are kept on the counters for sale. This will ensure customers get fresh sweets even when buying the unpacked ones.

Also Read: 7-Video That Made Us Realise That Republic TV Entertainment Ke Liye Kuch Bhi Karega

4. TVs to get costlier

Buying a TV will get costlier from October 1 as the government will levy custom duty of 5% on its open sales imports. Due to this, a 32-inch TV may get costlier by Rs 600 and 42-inch TV by Rs 1,200-1,500.

5. More tax on money sent abroad

Now people sending money abroad for whatever purpose will have to pay an additional 5% at tax collected at source (TCS). The Finance Act, 2020, states that anyone sending money abroad will have to pay TCS under the liberalised remittance scheme of RBI.

Also Read: Suhana Khan Trolled After She Shares Post On ‘Ending Colourism’ While SRK Promotes Fairness Cream

Feature image credits – Time Magazine