Online transactions have become more common in India as a result of the government’s focus on “Digital India.” The cash may now be instantly transferred from one bank to another. They faced lengthy lineups earlier to perform the same task.

Users will soon be able to send money up to 5 lakh via the Immediate Payment Service (IMPS) by just entering the recipient’s telephone number and bank account name. The beneficiary account number and the Indian Financial System Code (IFSC) will no longer need to be entered manually thanks to the streamlined process.

What Is IMPS?

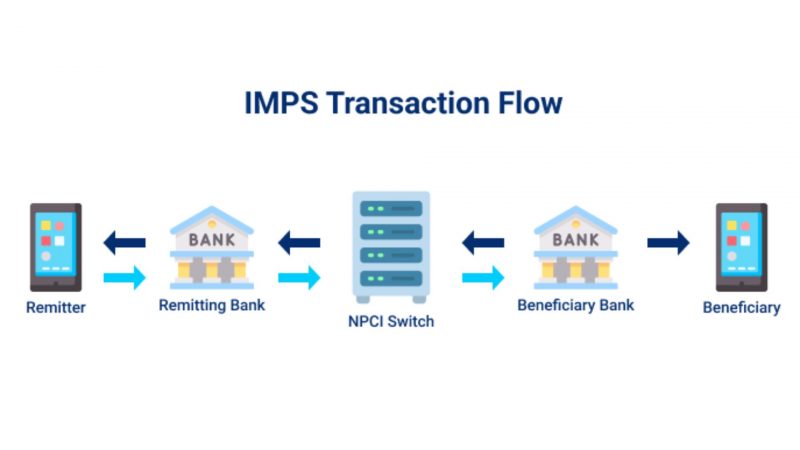

An instant money transfer service called IMPS is facilitated by the National Payment Corporation of India (NPCI). Immediate Payment Service is referred to as IMPS. Customers can make and receive payments in real-time from savings accounts using this payment channel. The program enables inter-bank transactions using mobile banking and internet banking.

IMPS Accessibility

It is available 365 days a year. Unlike bank offices, which are closed on observed public holidays, IMPS is available 24/7. This guarantees that the money you transfer will reach its recipient even on bank holidays.

IMPS Transfer Charges And Eligibility Criteria

The amount of money you are transferring using this method will determine the IMPS fees. The range is between Rs. 2.5 to Rs. 25. These fees might cost anywhere between Rs.10,000 and Rs. 5 lakh. You need to have a savings account with active mobile banking in order to use this option.

New Simplified IMPS: What NPCI has Proposed?

The IMPS user journey would be made simpler across banking channels including mobile banking, internet banking, etc., according to a recent announcement by NPCI. Now, users will just need to submit the beneficiary’s mobile number and bank name to complete a transaction. Beneficiary name validation will be done in real time together with this payment experience.

The new simplified IMPS is nothing more than a more streamlined variation of IMPS person-to-person payments utilizing mobile phones and MMIDs. Instead of providing the specific MMID, the sender will now enter or choose the recipient’s mobile number and bank name from the list of the banks enabled on the flow when transferring money

How Much Can You Send Through New Simplified IMPS?

According to NPCI, transfers using simplified IMPS up to Rs 5 lakh can be made without adding the beneficiary. “The streamlined IMPS payment transfer process can help be expanded to retail and business for use cases involving mass transactions,” NPCI says.

The highest limit will now differ from bank to bank based on their guidelines. “Banks typically offer two payment options, 1) Quick pay and 2) Transfer to the recipient are both available within their apps/net banking. Customers who choose the rapid pay option can manually input the beneficiary information and the payment amount.

The user will be able to send high-value payments to already added and validated beneficiaries under fund transfer to the beneficiary. Before completing the payment, the beneficiary validation will be used in both fast pay and beneficiary addition. Its purpose is to confirm the recipient’s name.