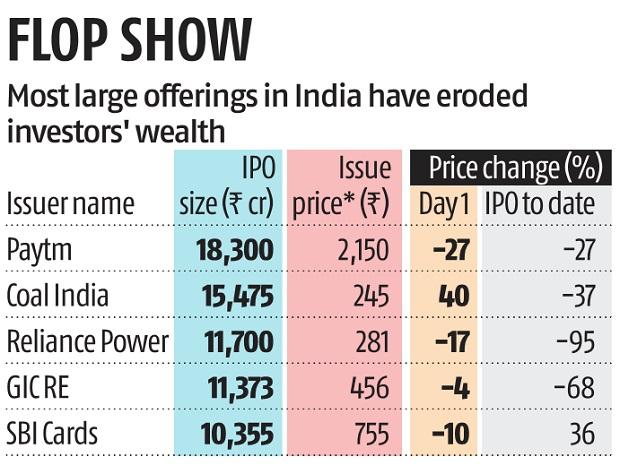

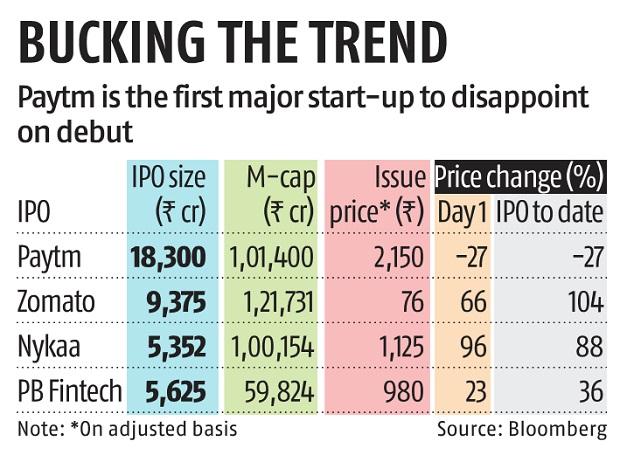

Paytm, a digital payments company, fell as much as 28% in a lackluster stock market debut on Thursday, less than a week after the country’s largest-ever initial public offering (IPO)

Paytm is funded by Chinese businessman Jack Ma’s Ant Group, Japan’s SoftBank, and Warren Buffett’s Berkshire Hathaway, who together hold around one-third of the firm.

What Analysts Said To NDTV About Paytm’s Weak Listing:

According to Anurag Singh, Managing Partner of Ansid Capital, “It was quite predictable. Although checking at some of the other listings, I wasn’t expecting such a precipitous drop, since Zomato, Policybazzar, and Nykaa pricing have remained stable. There is a little demand-supply mismatch, which prevents the proper price discovery in many of these new generation IPOs. Paytm is seeking a valuation of $20 billion. According to this assessment, I own 20% of HDFC Bank, 40% of Kotak Bank, and 65% of Axis Bank. This is absolute financial craziness, and I believe that this kind of pricing has never made sense in the past, and etc.”

When asked whether the stock will recover, Mr. Singh said, “No… I’m astonished (if it does) by this level of interest. And here is the issue with all of these crazy IPOs: if one goes down, it brings all other IPOs down with it. If you hold something and it continues to increase, investors have confidence, but when it begins to fall, I believe that everyone becomes a sale.”

[ Also Read: SEBI Unveils Investors’ Charter About Securities Market ]

Despite a fall in Paytm’s share price on its debut, the firm was valued at over Rs 1 lakh crore. Analysts cited the firm’s exorbitant valuations as the cause for the stock’s first trading session decline.

According to Ajay Bagga, a market expert and investor, “What we’re seeing now is that loss-making, profit-less major corporations are holding out the pomegranate of prosperity to retail investors in the secondhand market, which is a risky move because these companies cannot be valued using conventional accounting principles (such as cash flows, margins, and profits). All of these firms are saying, don’t ask about profits; instead, look at the growth we’re generating; we have a very long runway ahead of us. Invest in us depending on our growth. As a result, Paytm was valued at 23 times its price to sales ratio (P/S). I believe that a financial firm cannot be valued just on the basis of P/S.

Numerous market players saw the stock’s lackluster launch as a hint that investors had grown weary of a recent spate of IPOs with inflated values.

As Founder and Director of Proficient Equities Ltd., Manoj Dalmia said, “Paytm, a digital payments company, was listed at a discount to its initial public offering price. The company is overvalued at 26 times price to sales (P/S FY23), compared to global peers at 0.3-0.5 times PSG (price to sales growth ratio); 75% of promoters are from other countries and are selling stakes worth 10,000 crores, or more than 50% of the IPO value; the company is not a market leader in any business.”