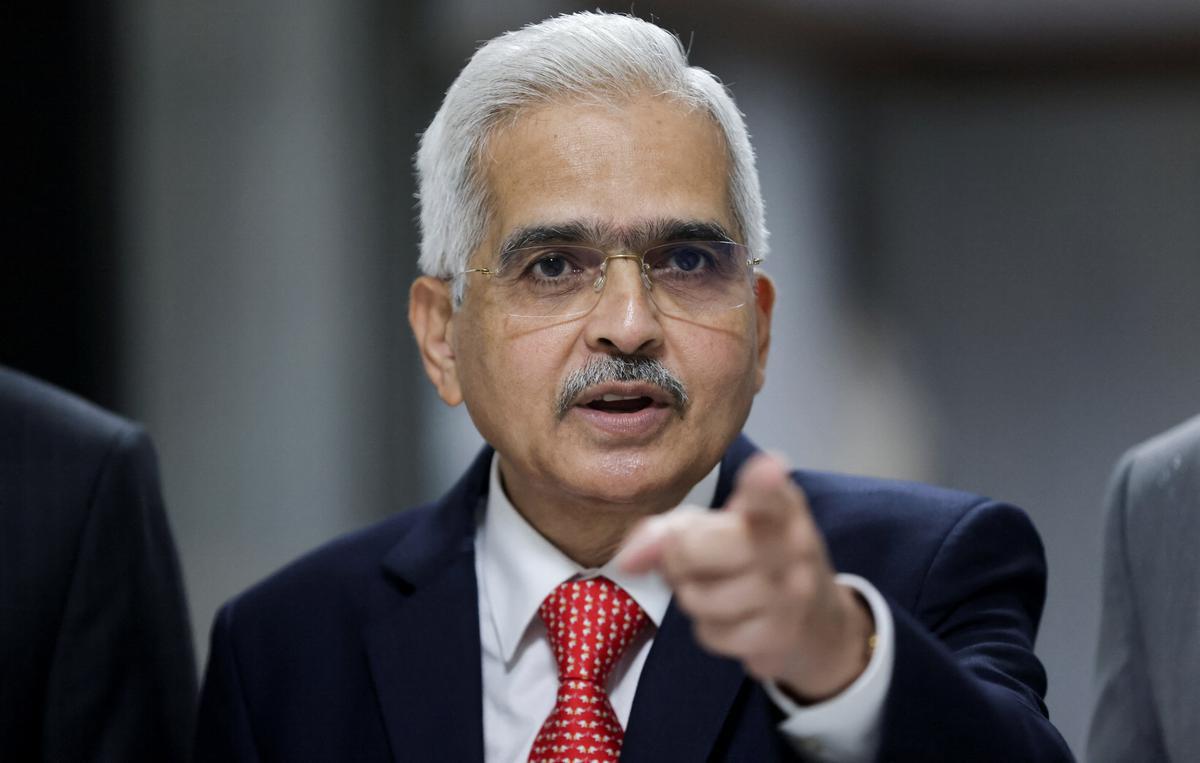

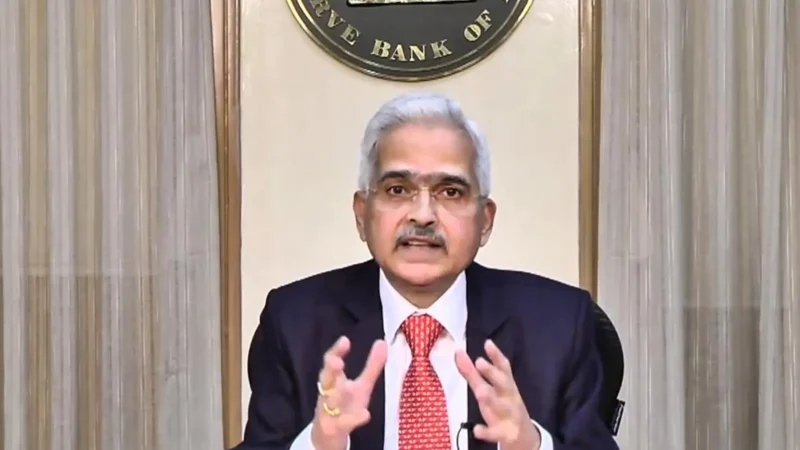

RBI’s Monetary Policy Committee (MPC) headed by Governor Shaktikanta Das has announced the most awaited decision. The Reserve Bank of India has released the new repo rates which are hiked again by 50bps to 5.90%, today. Many economists have already expected this half per cent hike as it was necessary to tame surging inflation which is now bouncing towards the 7 per cent mark. This is a straight fourth raise for the key lending rates in the currency cycle.

RBI Hikes Repo Rates By 50 Bps

In March 2020, to provide relief during COVID times, RBI lowered the repo rates and held them for two years before increasing them on May 4, 2022, when the inflation becomes unbearable. So far we have noted a total increase of 190 bps in RB’s key lending rates.

Inflation Forecast

The consumer price index (CPI) inflation forecast from the RBI remains unchanged at 6.7%.

GDP Growth

The gross domestic product (GDP) growth forecast is slashed by RBI from 7.2 per cent to 7 per cent in FY23.

Let’s Take A Look at What Experts Have To Say

Religare Broking

“RBI raising repo rate by another 50 bps was very much in line with market expectations but it’s the confidence of RBI in the economy which has been the highlight of monetary policy. Governor’s confidence that GDP growth rate for FY23 will remain at 7% comes from his statement,” noted.

“The late recovery in Kharif sowing, the comfortable reservoir levels, improvement in capacity utilization, buoyant bank credit expansion and government’s continued thrust on capital expenditure”, further added.

“Lastly, Deputy Governor Mr Michael Patra’s response to a question in the press conference where he stated, “soft-landing is for the developed economies, for India, it’s a take-off” sums up everything. We believe RBI and Government are handling the economy far better than their major global counterparts”, said Siddarth Bhamre, Research Head, Religare Broking.

Bandhan Bank

“The RBI commentary has been a finely balanced one – while global risks are discussed extensively, the RBI appears confident in the growth momentum in the Indian economy in the coming months. The modest downward revision in the FY23 GDP growth target to 7%, from 7.2% earlier, and leaving the inflation forecasts largely unchanged are on expected lines. While today’s RBI communication suggests future policy to remain data dependent and another round of rate hike cannot be ruled out, overall, the MPC refrained from springing any major surprise leading to broadly favourable reaction from most segments of financial markets,” said Siddhartha Sanyal, Head Economist and Chief of Research, Bandhan Bank.

Mahindra & Mahindra on RRB Provided Internet Banking Services

“The move to rationalise criteria that allows Regional Rural Banks (RRBs) to provide internet banking facilities to their customers will help improve the reach of digital banking in rural areas”, Sachchidanand Shukla, CE, Mahindra & Mahindra.

Also read:

UPI-Credit Card Linking Is A Potential Threat To Visa, Mastercard?

Tata Mutual Fund

“RBI has lowered its GDP growth forecast and CPI inflation has been maintained at 6.7% for the current financial year. 67% of the fall in forex reserves by 100 billion USD is due to the revaluation effect. RBI refuses to state what could be the terminal repo rates and remain date-dependent. Overall, the monetary policy is not as hawkish as the market expected. Global adverse development has been acknowledged but RBI’s monetary policy stance is predominantly domestic driven. Rates market should take this positively and should trade in a range”, Murthy Nagarajan from Tata Mutual Fund.