According to Shaktikanta Das, while the majority of banks have historically offered floating-rate loans, there is already a tendency toward fixed-rate loans.

Especially considering the fact that funding is abundant, the governor stated that banks must properly price the risk associated with the various loans they extend.

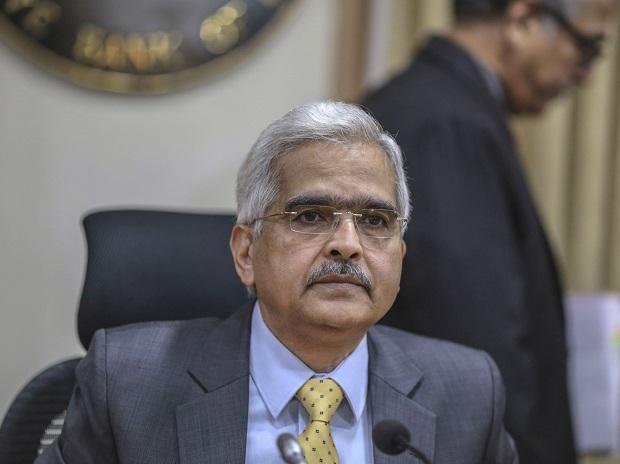

On Tuesday, Reserve Bank of India Governor Shaktikanta Das stated that the central bank is closely watching banks’ business models and plans. He underlined, though, that the federal bank’s approach is not designed to interfere with banks’ business decisions, but rather to alert lenders if any risk is accumulating.

At the RBI, we have begun examining banks’ business models and strategies more closely. We will not interfere with your business decisions, but we will monitor the development of vulnerabilities and hazards, and our first objective will be to alert banks, Das stated at the SBI’s Banking and Economic Conclave.

He stated that the RBI’s oversight is now practically real-time and is no longer a yearly effort. The advancement of technology has permitted a more in-depth examination of the monitoring process. While banks make business judgments, they should also consider the liquidity available and the interest rate arrangements they offer. These choices should be made with caution, he stated.

Regardless of the fact that liquid is abundant, the governor stated that banks must properly price the risk associated with the various loans they extend. The sheer presence of surplus liquidity should not result in the mispricing of loans, Das explained, because this excess liquidity will not persist indefinitely.

The RBI has high expectations for the Board’s supervision role, its composition, the skill profile of its directors, a solid risk and compliance structure and processes, increased transparency, and a robust mechanism for balancing the interests of diverse stakeholders, he noted. Das stated that banks had fared better than expected in the aftermath of the COVID-19 shock, with banks’ gross non-performing accounts and capital adequacy ratios improving further in September 2021 from June 2021 levels.

There are obstacles to overcome ahead, he said, which will need serious reflection and behavior on the part of something like the banking industry. Das stated that one of the difficulties banks are likely to confront is dealing with stressed debtors as a result of COVID-19.

The RBI issued Resolution Frameworks 1.0 and 2.0 during the two COVID-19 rounds to provide assistance to borrowers and banks. As assistance measures begin to wind down, some of these restructuring accounts may encounter solvency concerns in the coming quarters. Prudence would dictate that such unviable businesses be identified in advance for pragmatic closure measures, he said.