ITR Filing

-

Viral News

CBDT Extends Due Date for Filing ITR-7, Form 10BB, Form 10B

The Central Board of Direct Taxes or CBDT extends the due date to file ITR-7 and ITR 10B/10BB from September…

Read More » -

Business

Warning! Income Tax India Says Your ITR Refund Will Not Be Credited Into These Bank Accounts

All the taxpayers are currently waiting for their income tax refund, which is pending to be credited into their bank…

Read More » -

Business

Income Tax Department Launches New and Improved Website For Enhanced Taxpayer Experience

In an effort to improve the taxpayer experience and connect with new technological trends, the Income Tax Department has launched…

Read More » -

Business

Alert Taxpayers! IT Department Plans to Reduce Income Tax Refund Processing Time

Waiting for your refund is full of frustration. We have no clue when they are exactly going to be credited.…

Read More » -

Business

How Much Penalty Will be Levied for Updated, Belated or Revised ITR?

The cut-off date for submitting the original Income Tax Return or ITR was July 31, but there’s no need to…

Read More » -

Business

ITR Filing Deadline is Over, Now It’s Time to File Revised Returns, Here’re the Steps

The deadline to file Income Tax Return or ITR has ended on July 31st. Now it’s time to focus on…

Read More » -

Business

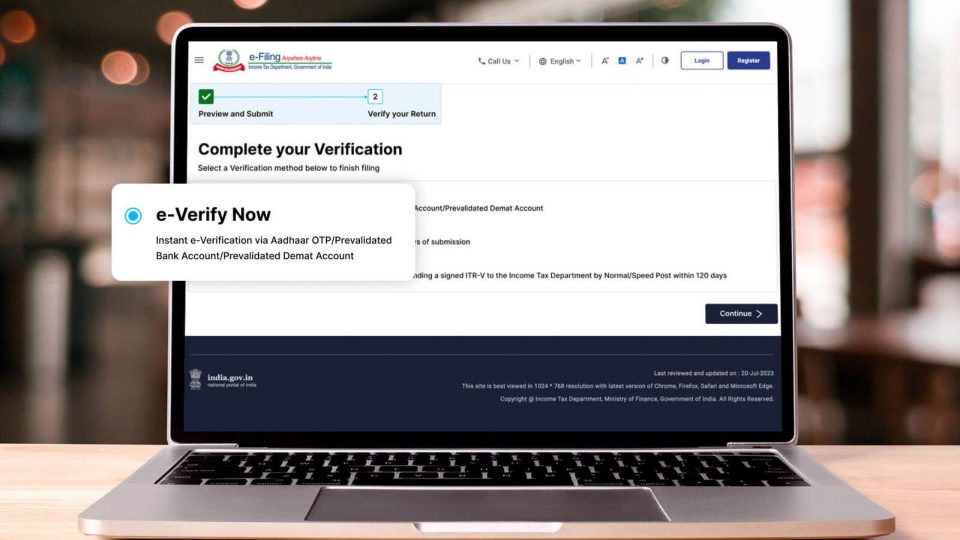

Alert! Your ITR Won’t Be Processed if Not E-verified, Here the Steps to Do It

ITR filing is the process through which a taxpayer honestly discloses every income source, asset, loss, expense, liability and accurate…

Read More » -

Business

Everything You Need To Know About ITR Filing 2023 Updates and Deadline

The income tax return deadline has finally arrived after weeks of advertising and awareness raising to encourage individuals to complete…

Read More » -

Business

How You Can Utilize AIS to File ITR Easily?

The Income Tax Department provides taxpayers with the Annual Information Statement or AIS. This is an unavoidable document for taxpayers…

Read More » -

Business

Various Alternative Methods for Filing Your Income Tax Returns in 2023-24

Filing an Income Tax Return (ITR) is a legal requirement for all Indian taxpayers. The ITR filing deadline for Assessment…

Read More » -

Business

Important Tax Reminder: Failure to Mention The Income In ITR Could Result In Rs 10 Lakh Penalty

The deadline for filing income taxes for fiscal year 2023-24 is July 31st. Those who fail to file their income…

Read More » -

Business

Change Your Bank Account Details After Filing ITR

When filing their income tax return (ITR) to claim a refund, taxpayers must include their bank account number. It is…

Read More » -

Education

How to Claim Income Tax Refund and Steps to Check Status Online?

Some taxpayers end up paying more than the required tax amount. The reason can be because of either tax deducted…

Read More » -

Business

Avoid These Common Mistakes While Filing Your Income Tax Return

The Income Tax Department’s deadline for filing income tax returns is July 31st. The department announced that the 1 crore…

Read More » -

Business

ITR Filing: Do You Need to File ITR With Zero Tax Liability?

ITR filing last date for the financial year 2022-23 and assessment year 2023-24 is July 31, 2023. Every earning individual…

Read More » -

Business

ITR Filing: How to Choose a Tax Regime for Yourself

Currently, in India, there exist two tax regimes: the new tax regime and the old tax regime. The new tax…

Read More » -

Business

Taxpayers! No Need to Wait for Form 16, File ITR This Way

The due date for submitting the Income Tax Return (ITR) for the fiscal year 2022-23 (assessment year 2023-24) is July…

Read More » -

Business

ITR Filing for FY 2023-24: Common Mistakes People Always Do

Now that the e-filing portal has been enabled taxpayers can now begin filing Income Tax Return or ITR for the…

Read More »