If you are searching for a safe investment plan and get stuck on PPF vs VPF then this article can help you. When investors want to invest in risk-free fixed income plans. They generally, face the problem of whether to choose Public Provident Fund (PPF) or Voluntary Provident Fund (VPF). However, both the investment schemes have similarities as well as differences. They have the same potential, similar returns, and other investment-related factors. But their varying factors are eligibility, investment period, exact return rates, tax benefits and many more.

Let’s see some questions that can enlighten you to choose PPF vs VPF?

Who are eligible for these schemes?

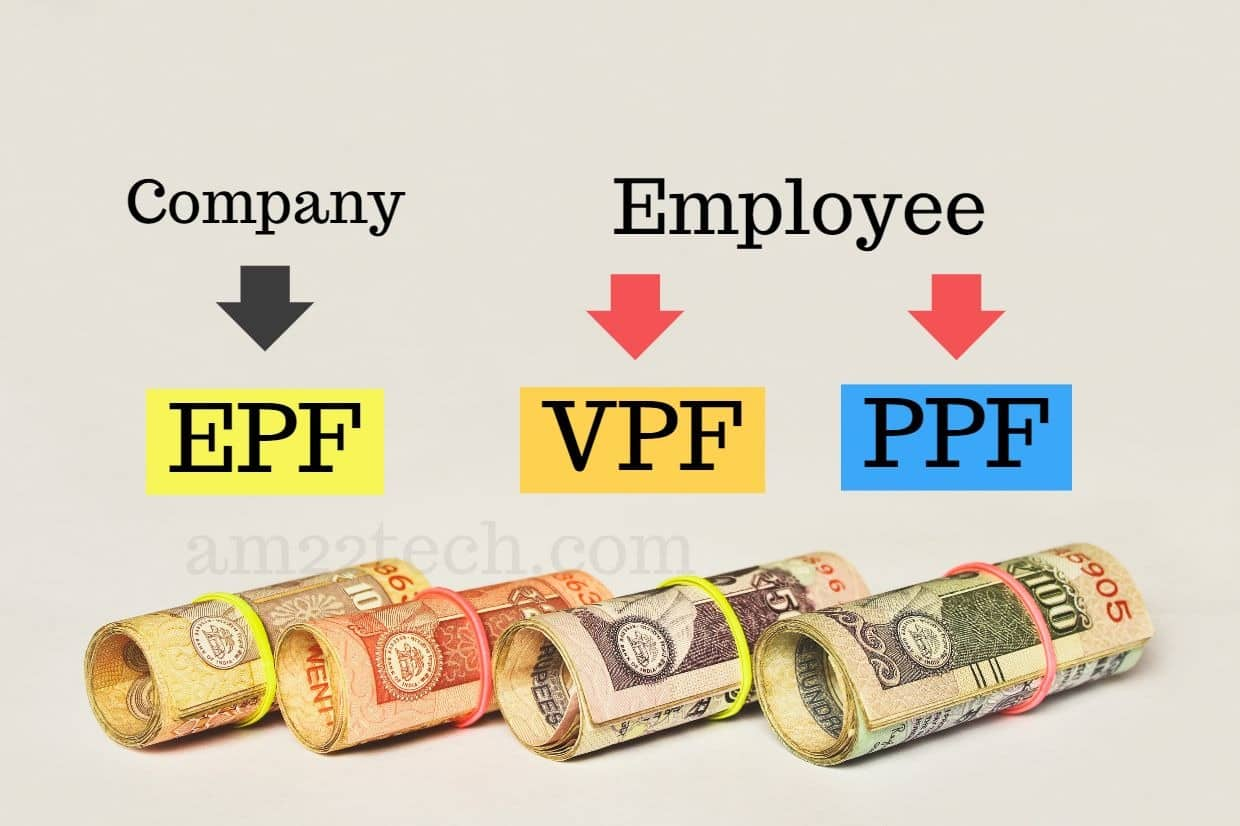

VPF or Voluntary Provident Fund comes under the general provident fund saving schemes. The employees who regularly make contributions towards EPF are eligible to invest in this VPF. As the name sounds this scheme is voluntary for all the members. Opposite of VPF, anyone can invest in the PPF scheme. Even a minor can open a PPF account with the permission of parents or guardians.

Which has higher returns?

On investment towards PPF investors will get an interest rate of 7.1% annually from 1st Jan 2022. Remember that PPF returns are improvised by the government quarterly. On the other hand, the current interest rate on VPF contributions that the investors can earn is 8.5% which is higher than PPF.

Also read:

Steps To Open PPF Sukanya Samriddhi Yojana Account SBI

Who is more tax saving?

VPF offers deductions under Section 80C of the Income Tax Act, 1961 on investment amounts up to 1.5 lakh. PPF also offers the same deduction, but on maturity, tax deductions can vary on return earned. Thus, the PPF amount that is received by investors on maturity is tax-free. But there is a limit of Rs.1.5 lakh to invest in this scheme for one year.

What are the maximum and minimum Investment amounts?

For the PPF account holders, the minimum amount to invest is Rs.500 and the maximum amount is Rs.1.5 lakh for each year. If you don’t invest a minimum of Rs.500 each year, then your account will be declared inactive. On the other hand, VPF has no such limitations on investments.

What are the Investment Periods for PPF vs VPF?

For PPF period of investment is 15 years. For the VPF the period is till retirement at the age of 58 years. In VPF there are no extensions allowed but for PPF extensions is possible with the block of 5 years.

Where Should you invest?

The best investment option for a safe investor is when he or she gets higher returns with lower risks. Both PPF and VPF fulfil this criterion to have lucrative returns with low risks. The only way to decide is to analyse your goals and think about how much time period you want to invest.